One of the most expensive items you walk around with is your cell phone. And the frequent in-and-out of your pocket gives your phone a steep chance of breaking. That’s why cell phone insurance is a great thing to have and even better, you can get it as a free benefit with many credit cards.

In this post we will discuss everything you need to know about cell phone protection.

The basics

Before we go into the nitty gritty terms for each card first, let’s discuss the basics.

Cell phone protection will offer coverage in a case where your phone is damaged or stolen. The coverage usually has a deductible ranging from $50- $100.

To activate coverage you need to pay your monthly “Eligible Cellular Wireless Telephone bill” with your “Eligible Card Account”. That means that the credit card with cell phone protection must be used to pay your monthly bills for the cell phone you need protection on. The previous month’s bill must have already been charged on the Eligible Account.

You do NOT need to purchase the phone with your eligible credit card in order to activate coverage.

“Cell phone protection” is not the same thing as “purchase protection”. The difference between the two is that purchase protection covers the purchase up to 90 days after the purchase is made, while cell phone protection protects your phone for its lifetime (as long as the monthly phone bill is paid with the eligible card).

Now lets see what is included in cell phone protection for each bank and some detailed terms

Cell phone protection on Amex cards*

Eligible cards and coverage amount

| Cell Phone Coverage | |

| Amex Platinum | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone is damaged or gets stolen. Max 2 claims per year. |

| The Business Platinum Card from American Express | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone is damaged or gets stolen. Max 2 claims per year. |

| American Express Platinum Delta | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone is damaged or gets stolen. Max 2 claims per year. |

| Delta SkyMiles Platinum Business American Express Card | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone is damaged or gets stolen. Max 2 claims per year. |

| Delta SkyMiles Reserve Business American Express Card | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone is damaged or gets stolen. Max 2 claims per year. |

| Delta SkyMiles Reserve Amex Card | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone is damaged or gets stolen. Max 2 claims per year. |

| The American Express Platinum Card for Schwab | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone is damaged or gets stolen. Max 2 claims per year. |

| Morgan Stanley Amex Platinum | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone is damaged or gets stolen. Max 2 claims per year. |

What is covered?

Amex cell phone protection provides coverage if your phone breaks (including the screen), or is stolen (not lost).

How to activate coverage?

You need to charge your monthly cellphone bill to your eligible Amex card. The coverage will activate automatically from the first month you charge the bill to your card and will automatically end the first month that you do not charge the bill to your card.

What is not covered?

The following is excluded from coverage, based on Amex terms:

- Eligible cellular wireless telephone accessories other than the standard battery and standard antenna provided by the manufacturer;

- For consumer card accounts only, eligible cellular wireless telephones purchased for resale or for professional or commercial use;

- Eligible cellular wireless telephones that are lost or mysterious disappearance;

- Eligible cellular wireless telephones under the care and control of a common carrier, including, but not limited to, the U.S. postal service, airplanes or delivery service;

- Eligible cellular wireless telephones which have been rented, leased, borrowed or cellular wireless telephones that are received as part of a prepaid plan;

- Cosmetic damage to the eligible cellular wireless telephone.

- Damage or theft resulting from abuse, intentional acts, fraud, hostilities of any kind (including, but not limited to, war, invasion, rebellion or insurrection), confiscation by the authorities, risks of contraband, illegal activities, normal wear and tear, flood, earthquake, radioactive contamination, or damage from inherent product defects or vermin;

- Damage or theft resulting from mis-delivery or voluntary parting from the eligible cellular wireless telephone;

- Replacement eligible cellular wireless telephone(s) purchased from anyone other than a cellular service provider’s retail or internet store that has the ability to initiate activation with the cellular service provider;

- Taxes, delivery or transportation charges or any fees associated with the service provided; or

- Losses covered under a warranty issued by a manufacturer, distributor or seller.

Cell phone protection on Chase cards

Eligible cards and coverage amount

| Credit Card | Cell Phone Coverage |

| Ink Business Preferred Credit Card | Get reimbursed for up to $1,000 per claim (with a $100 deductible) if your cell phone breaks or gets stolen. Max 3 claims per year. |

| Chase Freedom Flex | Get reimbursed for up to $800 per claim, and up to $1,000 per year (with a $50 deductible) if your cell phone is damaged or gets stolen. Max 2 claims per year. |

What is covered?

Chase cell phone protection provides coverage if your phone breaks (including the screen), or is stolen (not lost).

How to activate coverage?

You need to charge your monthly cellphone bill to your eligible Chase card. The coverage will activate automatically from the first day you charge the bill to your card and will automatically end the first day that you do not charge the bill to your card

What is not covered?

The following is excluded from coverage, based on Chase terms:

- Electronic issues, such as inability to charge, mechanical or battery failure;

- Cellular phone accessories other than a standard battery and/or standard antenna provided by the manufacturer;

- Cellular phones purchased for resale;

- Cellular phones that are lost or “mysteriously disappear,” meaning that the cellular phone vanished in an unexplained manner without evidence of a wrongful act by a person or persons;

- Cellular phones under the care and control of a common carrier, including but not limited to, the U.S. Postal Service, airplanes, or delivery service;

- Cellular phones stolen from baggage unless hand-carried and under your personal supervision, or under supervision of your traveling companion;

- Cellular phones which have been rented, borrowed, or are part of prepaid or “pay as you go” plans;

- Cosmetic damage to the cellular phone or damage that does not impact the cellular phone’s capabilities and functionalities;

- Damage or theft resulting from abuse, intentional acts, fraud, hostilities of any kind (including but not limited to war, invasion, rebellion, or insurrection), confiscation by the authorities, risks of contraband, illegal activities, normal wear and tear, flood, earthquake, radioactive contamination, or damage from inherent product defects;

- Damage or theft resulting from mis-delivery or voluntary parting with the cellular phone;

- Taxes, delivery and transportation charges, and any fees associated with the cellular service provider.

Cell phone protection on Barclays cards

Eligible cards and coverage amount

| Credit Card | Cell Phone Coverage |

| Miles & More World Elite Mastercard | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Barclay Advantage Aviator Business | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,200 per year. |

| JetBlue Plus Card | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Hawaiian Airlines | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Hawaiian Airlines Business | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,200 per year. |

| Barclays Advantage World Elite MasterCard | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| JetBlue Business | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,200 per year. |

| JetBlue Card | Get reimbursed for up to $600 per claim (with a $100 deductible) if your cell phone breaks or gets stolen. Max 3 claims per year. |

| Frontier Airlines World MasterCard | Get reimbursed for up to $600 per claim (with a $100 deductible) if your cell phone breaks or gets stolen. Max 3 claims per year. |

| Choice Privileges Visa Signature Card | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Emirates Skywards Rewards World Elite Mastercard | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Emirates Skywards Premium World Elite Mastercard | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Carnival World Mastercard | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Wyndham Rewards Earner Business Card | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

What is covered?

Barclays cell phone protection provides coverage if your phone breaks (including the screen), or is stolen (not lost).

How to activate coverage?

You need to charge your monthly cellphone bill to your eligible Barclays card. The coverage will activate automatically from the first day of the month you charge the bill to your card and will automatically end the first day of the month that you do not charge the bill to your card.

What is not covered?

The following is excluded from coverage, based on Barclays terms:

- Eligible cellular wireless telephone accessories other than the standard battery and standard antenna provided by the manufacturer;

- Eligible cellular wireless telephones purchased for resale or for professional or commercial use;

- Eligible cellular wireless telephones that are lost or mysteriously disappear;

- Eligible cellular wireless telephones under the care and control of a common carrier, including, but not limited to, the U.S. postal service, airplanes or delivery service;

- Eligible cellular wireless telephones stolen from baggage unless hand-carried and under the eligible person’s supervision or under the supervision of the eligible person’s traveling companion who is previously known to the eligible person;

- Eligible cellular wireless telephones stolen from a construction site;

- Eligible cellular wireless telephones which have been rented or leased from a person or company other than a cellular provider;

- Eligible cellular wireless telephones which have been borrowed;

- Eligible cellular wireless telephones that are received as part of a prepaid plan;

- Cosmetic damage to the eligible cellular wireless telephone or damage that does not impact the eligible cellular wireless telephone’s ability to make or receive phone calls (including minor screen cracks and fractures less than 2 inches in length that do not prevent the ability to make or receive phone calls or to use other features related to making or receiving phone calls);

- Damage or theft resulting from abuse, intentional acts, fraud, hostilities of any kind including, but not limited to, war, invasion, rebellion or insurrection), confiscation by the authorities, risks of contraband, illegal activities, normal wear and tear, flood, earthquake, radioactive contamination, or damage from inherent product defects or vermin.

Cell phone protection on Capital One cards

Eligible cards and coverage amount

| Credit Card | Cell Phone Coverage |

| Capital One Spark Cash Select for Excellent Credit | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Capital One Venture X Rewards Credit Card | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max 3 claims per year. |

| Capital One Spark Miles for Business | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Capital One Platinum Credit Card | Get reimbursed for up to $600 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Capital One QuicksilverOne Cash Rewards Credit Card | Get reimbursed for up to $600 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Capital One Quicksilver Cash Rewards Credit Card | Get reimbursed for up to $600 per claim with a $50 deductible if your cell phone breaks or is stolen. Max $1,000 or 2 claims per year. |

| Capital One Savor Cash Rewards Credit Card | Get reimbursed for up to $600 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Capital One SavorOne Cash Rewards Credit Card | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Capital One Walmart Rewards Card | Get reimbursed for up to $600 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Capital One Spark Miles Select Business Card | Get reimbursed for up to $800 per claim (with a $50 deductible) if your cell phone breaks or gets stolen. Max $1,000 or 2 claims per year. |

| Capital One SavorOne Student Cash Rewards Credit Card | Get reimbursed for up to $600 per claim with a $50 deductible if your cell phone breaks or is stolen. Max $1,000 or 2 claims per year. |

| Capital One Quicksilver Student Cash Rewards Credit Card | Get reimbursed for up to $600 per claim with a $50 deductible if your cell phone breaks or is stolen. TMax $1,000 or 2 claims per year. |

What is covered?

Capital One cell phone protection provides coverage if your phone breaks (including the screen), or is stolen (not lost).

How to activate coverage?

You need to charge your monthly cellphone bill to your eligible Capital One card. The coverage will activate automatically from the first day of the month you charge the bill to your card and will automatically end the first day of the month that you do not charge the bill to your card.

What is not covered?

The following is excluded from coverage, based on Capital One terms:

- Eligible cellular wireless telephone accessories other than the standard battery and standard antenna provided by the manufacturer;

- Eligible cellular wireless telephones: purchased for resale or for professional or commercial use; that are lost or mysteriously disappear; under the care and control of a common carrier, including, but not limited to, the u.s. postal service, airplanes or delivery service; stolen from baggage unless hand-carried and under the eligible person’s supervision or under the supervision of the eligible person’s traveling companion who is previously known to the eligible person;

- Stolen from a construction site;

- Which have been rented or leased from a person or company other than a cellular provider;

- Which have been borrowed;

- That are received as part of a prepaid plan;

- Cosmetic damage to the eligible cellular wireless telephone or damage that does not impact the eligible cellular wireless telephone’s ability to make or receive phone calls (including minor screen cracks and fractures less than 2 inches in length that do not prevent the ability to make or receive phone calls or to use other features related to making or receiving phone calls);

- Damage or theft resulting from abuse, intentional acts, fraud, hostilities of any kind (including, but not limited to, war, invasion, rebellion or insurrection), confiscation by the authorities, risks of contraband, illegal activities, normal wear and tear, flood, earthquake, radioactive contamination, or damage from inherent product defects or vermin;

- Damage or theft resulting from mis-delivery or voluntary parting from the eligible cellular wireless telephone;

- Replacement of eligible cellular wireless telephone(s) purchased from anyone other than a cellular service provider’s retail or internet store that has the ability to initiate activation with the cellular service provider;

- Taxes, delivery or transportation charges or any fees associated with the service provided; and

- Losses covered under a warranty issued by a manufacturer, distributor or seller.

How to file a claim?

To file a claim, you should contact the benefit administrator department of your card.

Amex: You can call 1-833-784-1467 to open a claim. You must report the claim within 90 days of the loss, or as soon as reasonably possible, or the claim may not be honored.

Chase: You can call 1-804-673-1691 or visit www.cardbenefitservices.com to open a claim. You must report the claim within 60 days of the loss, or as soon as reasonably possible, or the claim may not be honored.

Barclays: You can call 1-800-Mastercard or visit mycardbenefits.com to open a claim. You must report the claim within 90 days of the loss, or as soon as reasonably possible, or the claim may not be honored.

Capital One: You can call 1-800-Mastercard or visit www.mycardbenefits.com to open a claim. You must report the claim within 90 days of the loss, or as soon as reasonably possible, or the claim may not be honored.

You will usually need to provide three pieces of evidence

- Cell phone bill (that includes the phone number on bill)

- Credit card statement that shows the date you paid the bill (the dates and amounts need to match your credit card statement)

- Repair estimate showing how much it would cost to repair your phone

Where can I get a repair estimate?

You can either take your phone to a local repair shop or get a free repair estimate on https://ubreakifix.com/.

More cards that offer cell phone protection

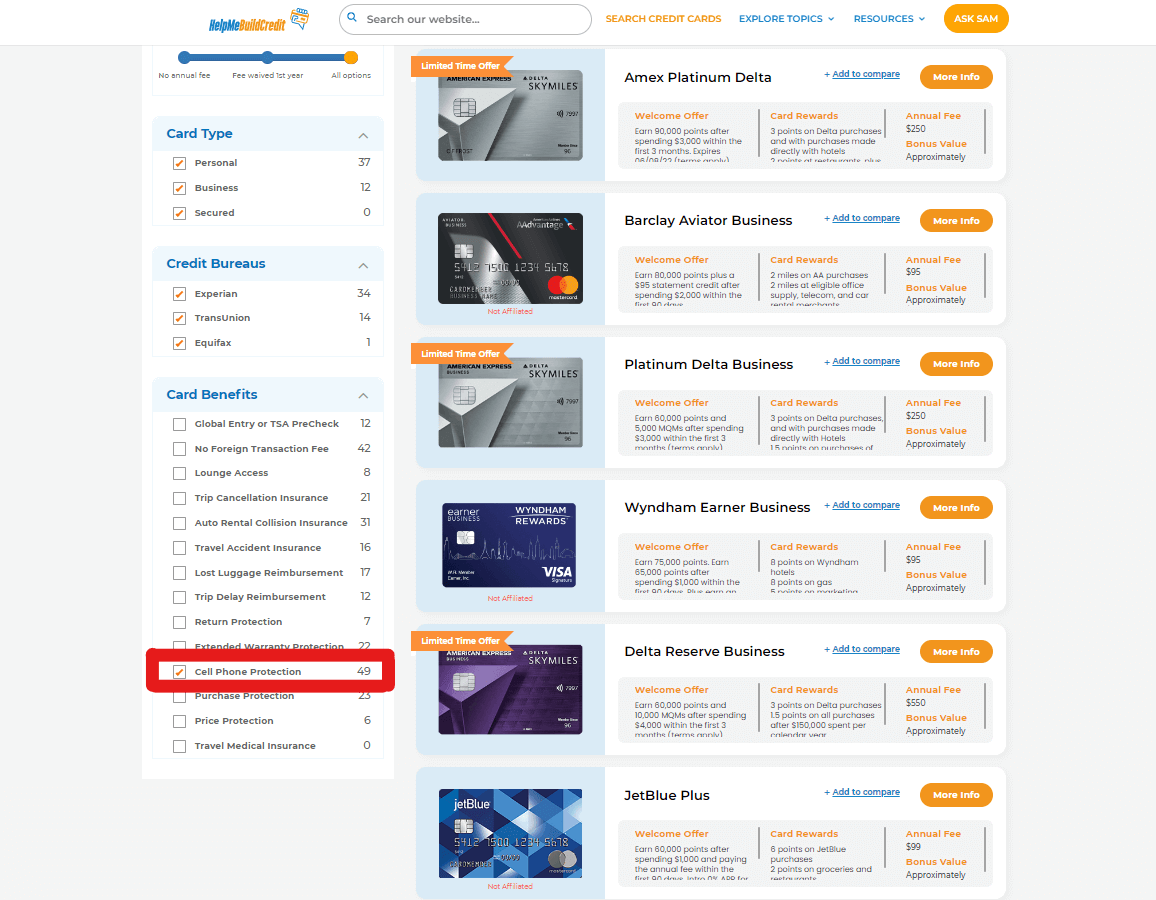

You can find a full list of cards that offer cell phone protection with our Ultimate Credit Card Finder. Just click on the “cell phone protection” benefit and it will spit back results of the cards that include cell phone protection.

*Coverage for a stolen or damaged eligible cellular wireless telephone is subject to the

terms, conditions, exclusions and limits of liability of this benefit. The maximum liability is $800, per claim, per eligible card account. Each claim is subject to a $50 deductible. Coverage is limited to two (2) claims per eligible card account per 12 month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments