We launched our credit card database less than a year ago in August 2020, and wow! We’ve already collected over 1000 credit card submissions! Congratulations to our dear users on reaching this milestone!

In the short time the database has been around, it’s taken off quickly as a hot pancake. There’s, thank goodness, lots of traffic on the page and it’s all thanks to you, our users, who are all helping each other out by posting your credit card application results.

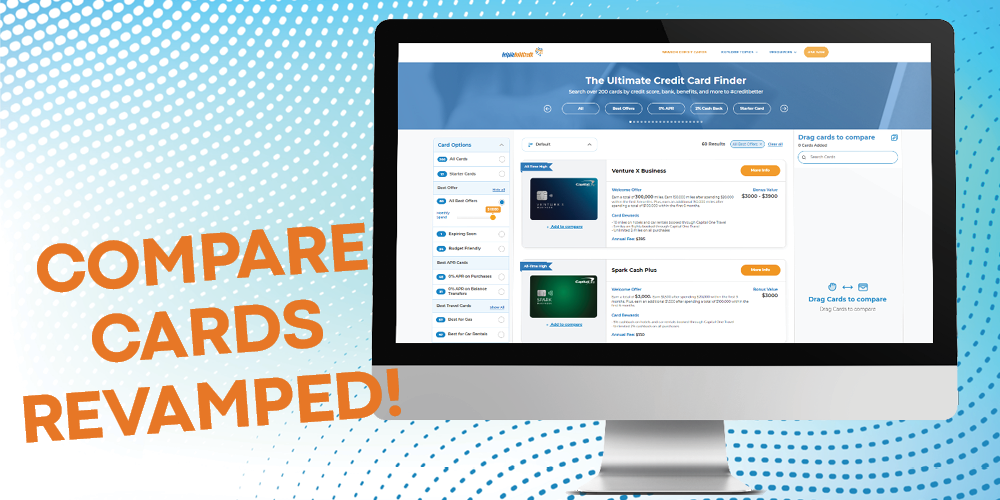

What is the credit card database?

For the sake of the consumers, we launched a simple-to-use credit card database. It has grown to become a fantastic database to check out when considering applying for a credit card. This database gives you an exact picture of which new credit card to choose, based on your credit and the credit of other consumers, just like you. Everyone gets to share which credit cards they applied for and if they were approved for the credit cards or not, and exactly due to what factors on their report and for which credit limit. And then all users, YOU included, can search amongst the hundreds of credit cards summitted by the many users, to make your next credit card decision. You can search the submissions according to real-time facts, which bank pulls which credit bureau and also search submissions by state.

If you recently applied for a new credit card and haven’t joined us yet, please join now. It’s fabulous! Go to the credit card database to fill out a report of what was involved in the acceptance or denial of the card you applied for. The details will show up alongside the card you applied for and for other users to see. This way, when you or your fellow users want to apply for a new credit card, you use this as your guide, like so many consumers are doing already!

Wow! 82% of our users got approved!

Another interesting fact that is also worth a celebration, while crunching the numbers we found that according to current statistics on our credit card database, 823 users were approved for the credit card they applied for and only 180 were denied the card they applied for. That comes to roughly 82.3% percent of credit cards from our users are being approved, while only 18% of credit card applications being denied. Wow, that’s the power of the knowledge we provide and the power we have by sharing one another’s application experience so others in the HMBC community can make wise decisions according to the submissions shared when choosing their own credit cards.

Submissions coming from 25 different states

Submissions are currently coming in from among 25 different states. We’ve got Alabama, Arizona, Arkansas, California, Florida, Georgia, Idaho, Illinois, Iowa, Kansas, Maine, Maryland, Massachusetts, Michigan, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Texas, Washington, North Carolina. We hope to soon be across all 50 states and get submissions from all over.

Stay tuned while you #creditbetter

Though so much good has come from the credit card database, we’re working on making it even better! We’re working on expanding the search tool to allow users to better drill down the credit card submissions. We’re hoping to add more search options real soon. Stay tuned!

The whole success of the database is due to our fantastic users who keep submitting your credit card results. We brought to you the credit card database to help you #creditbetter, and you are really being there for consumers, helping each other #creditbetter.

So thanks again, congratulations on the 1000 credit card results milestone, and let’s keep those submissions coming!

0 Comments