Summer is coming, and we all will be hitting the road!

Every year before the summer, we update our post on auto rental insurance. Here is our 2023 version.

What is credit card auto rental insurance (CDW)?

You may be someone who does not own a car and relies on car rentals. What happens when you rent a car, head out on a trip, and then, god forbid, get into an accident? Usually what happens is, you have to pay the car rental company for the damages involved.

Here’s the thing. You may very well be saved by your credit card, though that heavily depends on which credit card you own. You may be the owner of a credit card that promises to cover damages to car rentals for collisions and they pay the damages to the rental company instead of you.

Let’s explore auto rental coverage, what’s covered and what’s not, the nitty-gritty terms, and which cards offer the best coverage.

Auto rental insurance covers collision or liability?

Credit cards with auto rental collision insurance will cover damages that happen to your rented car (collision), not the car you bump into (liability).

But here is the good news! In the USA, auto rentals are required to cover renters on liability for the state minimum. So you can rely on that for at least the minimum coverage (California and Texas do not have a state minimum).

If you have an auto insurance policy, then your policy will include insurance on rentals as well. If you do not own a car and have no auto insurance policy then you can either buy liability insurance from the rental company or you can purchase “Non-owners policy” for a decent price from Geico (currently only available by phone when calling a local agent).

The nitty-gritty terms

Even if you know your card has the benefit of car rental collision insurance you must make sure you know exactly what it covers as there are various terms to take note of. Read the agreement on your credit card to be fully in the know of what the credit card company will cover if it happens that you get into a car accident with your rented car.

Here are some points to take note of:

Not all cars are covered

Every credit card has a limit of up to how much money they will cover, usually for cars valued at up to $50,000 – $75,000 plus exclusions on the cars that are covered. Exclusions can include antique automobiles, vans designed to carry more than 9 people, vehicles that have an open cargo bed, trucks, motorcycles, mopeds, motorbikes, limousines, recreational vehicles, and more.

Primary or secondary

Some credit cards like the Sapphire Preferred offer primary coverage, which will pay even if you have other insurance coverages in place. With most credit cards the coverage is secondary which will require you to first file a claim with any other available insurance. This may delay the process, plus, it can increase your premium on your insurance policy.

Here is full list of card that offer primary coverage

1) card_name ($95 annual fee)

2) Chase Sapphire Reserve ($550 annual fee)

3) card_name ($95, waived 1st year)

4) United Quest ($250 annual fee)

5) United Club Infinite ($525 annual fee)

6) Capital One Venture X Rewards Credit Card* ($395 annual fee)

7) Us Bank Altitude Reserve* ($400 annual fee)

8) Chase Ink Cash on rentals for business purposes ($0 annual fee)

9) Chase Ink Unlimited on rentals for business purposes ($0 annual fee)

10) Chase Ink Preferred on rentals for business purposes ($95 annual fee)

11) card_name on rentals for business purposes ($195 annual fee)

12) United Business on rentals for business purposes ($99, waived 1st year)

13) Capital One Spark Cash Plus* on rentals for business purposes ($150 annual fee)

*excluding rentals in Israel, Jamaica, the Republic of Ireland, or Northern Ireland

On all Amex credit cards, you can buy Premium Protection for about $20 per rental. With Premium Protection you get primary coverage.

Amount of days covered

Every credit card has a max on how many days are covered. With some Capital One cards, the max is as little as 15 days for domestic rentals. With Amex, the standard coverage is for agreements up to 30 days, though you can purchase a premium plan which will offer primary coverage on agreements for up to 42 days.

Please note that on many cards, the max days are applicable to the rental agreement, so if your agreement is longer than the max days you will not be eligible for coverage even from day one.

Some countries are excluded

Some Capital One cards exclude cars rented in Israel, Jamaica, the Republic of Ireland, or Northern Ireland. Amex excludes Australia, Italy, and New Zealand. Chase offers worldwide coverage.

Check your cardmember agreement before traveling to make sure the country you’re visiting is covered.

Coverage for authorized users

Car rental insurance usually applies to you, the cardholder, and account authorized users, plus it also includes all additional renters on the same rental agreement. With Amex, coverage will extend to your spouse or domestic partner as well.

Which credit cards have auto rental insurance?

- All Chase cards offer worldwide coverage. You can find a list of all Chase cards with auto rental insurance here.

- All Amex cards offer worldwide coverage excluding Australia, Italy, and New Zealand. You can find a list of all Amex cards with auto rental insurance here.

- Many Capital One cards offer coverage but the terms are different for Capital One Visa cards and Capital One Mastercards. Coverage with Capital One is also tricky because some card members have coverage and some don’t. You need to always confirm with Capital One if your card includes coverage or not (in general, I see that cards with a $5k credit limit or more have coverage and cards with less than a $5k limit do not have coverage. But it’s always best to confirm directly with Capital One).

- All Barclays cards offer coverage but the terms are different between Barclays Visa cards and Barclays Mastercards. You can find a list of all Barclays cards with auto rental insurance here.

- Some Bank of America cards offer coverage. You can find a list of all Bank of America cards with auto rental insurance here.

- Some Wells Fargo cards offer coverage. You can find a list of all Wells Fargo cards with auto rental insurance here.

- Some US Bank cards offer coverage. You can find a list of all US Bank cards with auto rental insurance here.

- No Discover cards offer coverage.

- No Citi cards offer coverage.

You can find a full list of cards that offer auto rental insurance here.

How to activate coverage?

In order to activate the coverage, you need to reserve and pay the entire rental charge on your eligible card.

Some people make a mistake and reserve the car with any credit card they have in their wallet and later on change the card used to pay at the counter to their card that offers coverage. This is a mistake as the terms and conditions on most credit card agreements want you to reserve and pay for the car on the eligible credit card.

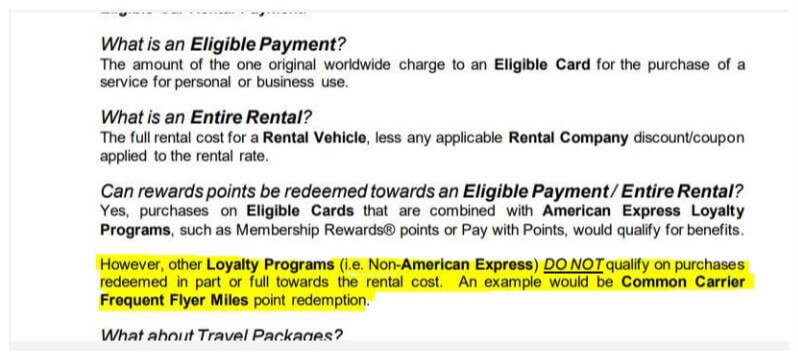

When using reward points, will I still get coverage?

As per the terms and conditions of Chase, Amex, Capital One Visa cards, and Barclays Visa cards, coverage will only apply once the rental is paid entirely with your eligible credit card. If you pay a portion of the car rental with a third-party reward program, including the rental agency reward programs or certificates, then you will not be eligible for coverage. The only exclusion is if you pay with Chase Ultimate Reward points or with Amex Membership Reward points. Then you’re still eligible for coverage as long as you use your eligible card to pay the remaining charges plus taxes and fees.

With eligible Mastercard’s (including eligible Capital One and Barclays Mastercard’s), you’re eligible for coverage even when you use third-party rewards or certificates, as long as a minimum of one day is paid on your eligible credit card.

Amex Platinum Card auto rental Insurance terms and conditions

Long term rentals

Avis, National, and Enterprise, create new contracts every 30 days for long term rentals. So these can work for long term rentals . But keep in mind that some credit card agreements include language that if you had a previous rental contract that ended within x amount of days before the new contract, then it’s still considered one long contract. I’ve rarely seen them make a big deal about it (as long as you have a new contract every 30 days), but if they do dig deeper and notice that it’s a long term rental then they might deny the claim.

To end off, read through your credit card benefits before you head out on your road trip and make sure you understand if you’re covered or not for anything you “bump into” on your journey.

Safe trip!

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

![The 9 Best Credit Cards For Tolls [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/09/post-on-best-cards-for-tolls-1-1080x675.png)

I had a crash but only i was involved, the rented car was an Infiniti QX60 and i used a chase freedom unlimited to pay for the rental, do i get full coverage from my credit card?

You will be covered for collision not laibilty

Is there any card that offers both liability and collision coverage?

Is chase Saphire the only card that offers primary coverage or are there others and could you recommend ?

There is no card that offers liability insurance. The following card have worldwide primary coverage 1) Chase Sapphire cards 2) Chase Ink cards (only for business rentals) 3)United cards (except the United Gateway no annual fee card) 4) Us Bank Attitude Reserve

Check out Wells Fargo business card. They may be primary.

SIXT Car rental is also renewing their contract every 30 days.

Great! Thanks for sharing

Do these credit cards offer collision insurance on car subscriptions?

officially not