You can be looking for a new card with a great offer but be stuck without the option for a Chase card.

Have no fear, all your other options are listed right here!

Why Can't I Apply For A Chase Card?

Many people can’t apply for a Chase card due to the Chase 5/24 rule.

Chase has a rule that a consumer cannot apply for a new personal Chase credit card if you opened 5 or more personal credit cards within the past 24 months.

That’s how you can find yourself looking for a new card with a good offer but feel like you’re bumping into walls by not being able to apply for any Chase credit card.

Filtering Your Options

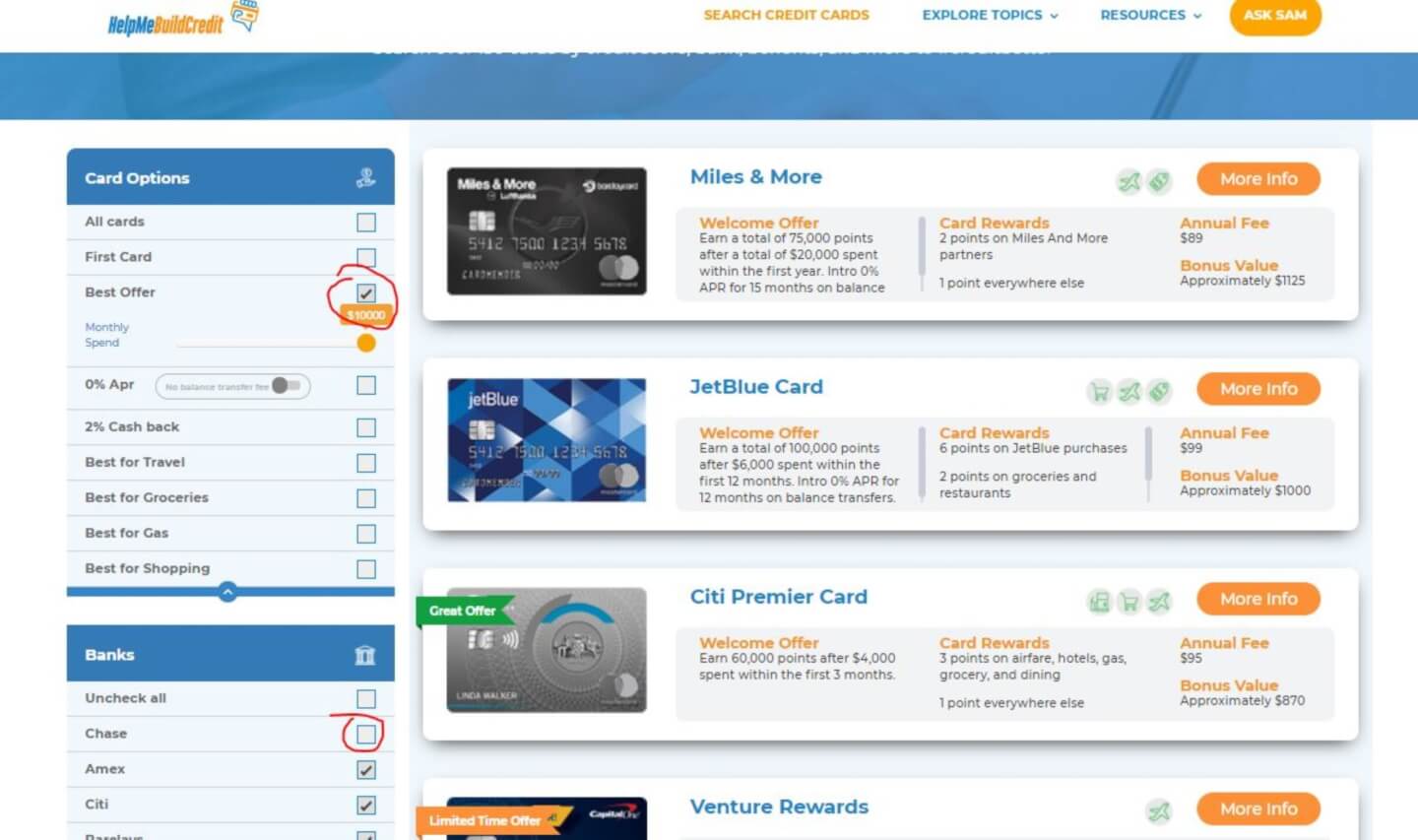

We’re going to take this problem and head over to our credit card finder. There, filter the card search to bring up all best offer results, from all banks besides Chase. Do that by selecting Best Offer in the Card Option box, and by selecting all banks besides for Chase in the Banks box.

There are some super deals, even if you can’t get your Chase cards.

Miles & More

With the Barclay Miles & More World Elite Mastercard, you will earn a total of 75,000 points after a total of $20,000 spent within the first year. You get 50,000 points after $3,000 spent within the first 3 months, and an additional 25,000 points after $20,000 spent within the first year.

That’s spending $1,000 a month for 3 months in order to get the 50,000 points. To get 75,000 points, spend a bit over $1,500 per month for one year.

The bonus value is $1,125. That’s high, plus, you get 0% APR on balance transfers for the first 15 months.

JetBlue

Next up, is the JetBlue card, also a Barclay card. Earn a total of 100,000 points after $6,000 spent within the first 12 months.

The bonus offer is split into two parts. You can earn 50,000 points after spending $1,000 within the first 3 months. Then you can earn the other 50,000 points after spending a total of $6,000 within the first 12 months.

All valued at $1,000 for JetBlue flight redemptions! And also, 0% APR for 12 months on balance transfers.

You can choose to check out the JetBlue Business card for the same offer as the JetBlue but in a business version.

Citi Premier Card

The Citi Premier card is a great one too. The offer is 60,000 points for $4,000 spent within the first 3 months. It’s a top offer from someone not eligible for the Chase Sapphire Prefered.

Venture Rewards

Capital One Venture Rewards has a welcome bonus of 60,000 points after $3,000 spent within the first 3 months. The points are worth a penny each when redeemed for travel.

The approximate bonus value is $600.

Amex Gold

Up next is the Amex Gold card for which we say, go for the gold! For a limited time, earn 60,000 points after $4,000 spent within the first 6 months. That’s spending almost $700 per month for 6 months for a bonus value of $900.

Notice the $100 annual airline incidental credit benefit. The benefit is valid throughout 2021. That means you can get to double-dip the $100. Apply for the card today, before January 2021, to get one set of $100, and then you’ll automatically get another $100 after January 2021! Totaling $200 in airline incidental fee credits. For which we say, double-dipping.

You Can Get A Good Offer

See? With the help of our credit card finder filtering out Chase, I’d say we came up with some pretty good options.

So if you’re stuck with the Chase 5/24 rule, try some of these cards for fantastic offers.

For a full list, visit The Ultimate Credit Card Finder.

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments