Just the other day, I was thinking, “Is there any credit card I can get from Amex that has no annual fee, but also has return protection?”

Some background

Return protection is a benefit some cards have. It lets you return a purchase you’re not happy with within an extended time frame after the purchase was made, even past the store return policy.

It’s a great benefit to have to compliment our decision-making; keep it, return it, keep it, just wait a little.

For a long while, Amex had 90-day return protection on most of their cards. That was until 01/01/20 when Amex removed return protection from most of their cards, leaving it only on their high-ended cards.

So knowing that, I was about to say to myself, “No, nowadays, there aren’t any no-annual-fee Amex cards to be gotten with return protection. It’s either you pay a high annual fee or you get no return protection”.

Before coming to that conclusion though, I decided to check the Ultimate Credit Card Finder to make sure what I was thinking was accurate.

The Ultimate Credit Card Finder

I launched helpmebuildcredit.com and visited the search credit card tab. That brought me to the Ultimate Credit Card Finder.

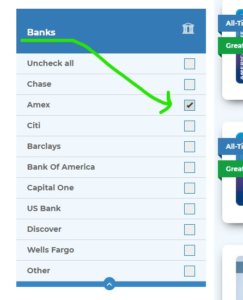

In the box with the list of banks, I made sure only Amex was checked off, to filter out only the Amex cards.

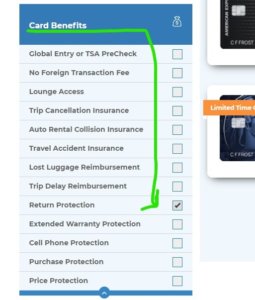

Now, instead of sifting through all Amex cards to see which ones have return protection, I just scrolled down to the last filter box labeled card benefits, and checked off return protection.

Lastly, I drilled down the options to finally show only all Amex cards that have return protection, AND no annual fee.

And wonders upon wonders, the Ultimate Credit Card Finder outsmarted me. He knows his stuff better than I do!

Up came two options to fit under our criteria of 1- Amex, 2- return protection, 3- no annual fee; the Amazon Business Prime card and the Amazon Business card.

Wow. He’s a smart smart aleck, that filter. And to think how easy and simple it was to filter my search to fit exactly what I was looking for, with just 3 clicks!

The Ultimate Credit Card Finder will search over 180 credit cards -and counting, and will assist you to easily find your next best card. Start drilling down your options. I bet we have something for you!

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments