With all the hype about AI technology, I decided to take it on a test spin to see if it can help me find a good credit card and to see what general value it has in the credit card space.

My results were pretty disappointing. They were wrong more times than they were right.

Though they might improve dramatically within the following months, as of now, they are still not there yet. But luckily, you’ve got our Ultimate Credit Card Finder in the meantime to help you find credit cards quickly and easily, and much more reliably.

I used Google Bard instead of ChatGPT

Chat GPT has been unplugged from the internet since somewhere in the middle of 2020. Credit card information changes as often as I change my socks (and I change socks once a day). Info from 2020 is already stale by now so as an alternative, I used Google Bard which takes live info from the internet to answer questions.

Let’s check out the results.

Q1- Which credit card has 2% cashback on all purchases with no annual fee and no foreign transaction fees?

Bard (my comments are in red): Here are some of the best credit cards that offer 2% cash back with no annual fee and no foreign transaction fees:

Capital One Quicksilver Cash Rewards Credit Card:

This card offers 2% cash back on all purchases (False), with no annual fee or foreign transaction fees.

Chase Freedom Unlimited®:

This card offers 1.5% cash back on all purchases, plus 5% cash back on travel purchased through Chase Ultimate Rewards®, 3% cash back on dining and drugstores, and 3% cash back on online shopping (excluding Walmart and Target) in the first year, all with no annual fee or foreign transaction fees (False. Card does have foreign transaction fees).

Wells Fargo Active Cash® Card:

This card offers 2% cash rewards on purchases, with no annual fee or foreign transaction fees (False. Card does have foreign transaction fees).

.PayPal Cashback Mastercard®: This card offers 2% cash back on all purchases, with no annual fee or foreign transaction fees (False. Card does have foreign transaction fees).

Bank of America® Customized Cash Rewards Credit Card:

This card offers 3% cash back on your top two eligible spending categories each month, up to $2,500 in combined spending per quarter (then 1%). There is no annual fee or foreign transaction fees. (False. Card does have foreign transaction fees).

My take: Complete disaster of an answer. It listed a lot of false information plus not all cards even earn 2% cashback on all purchases

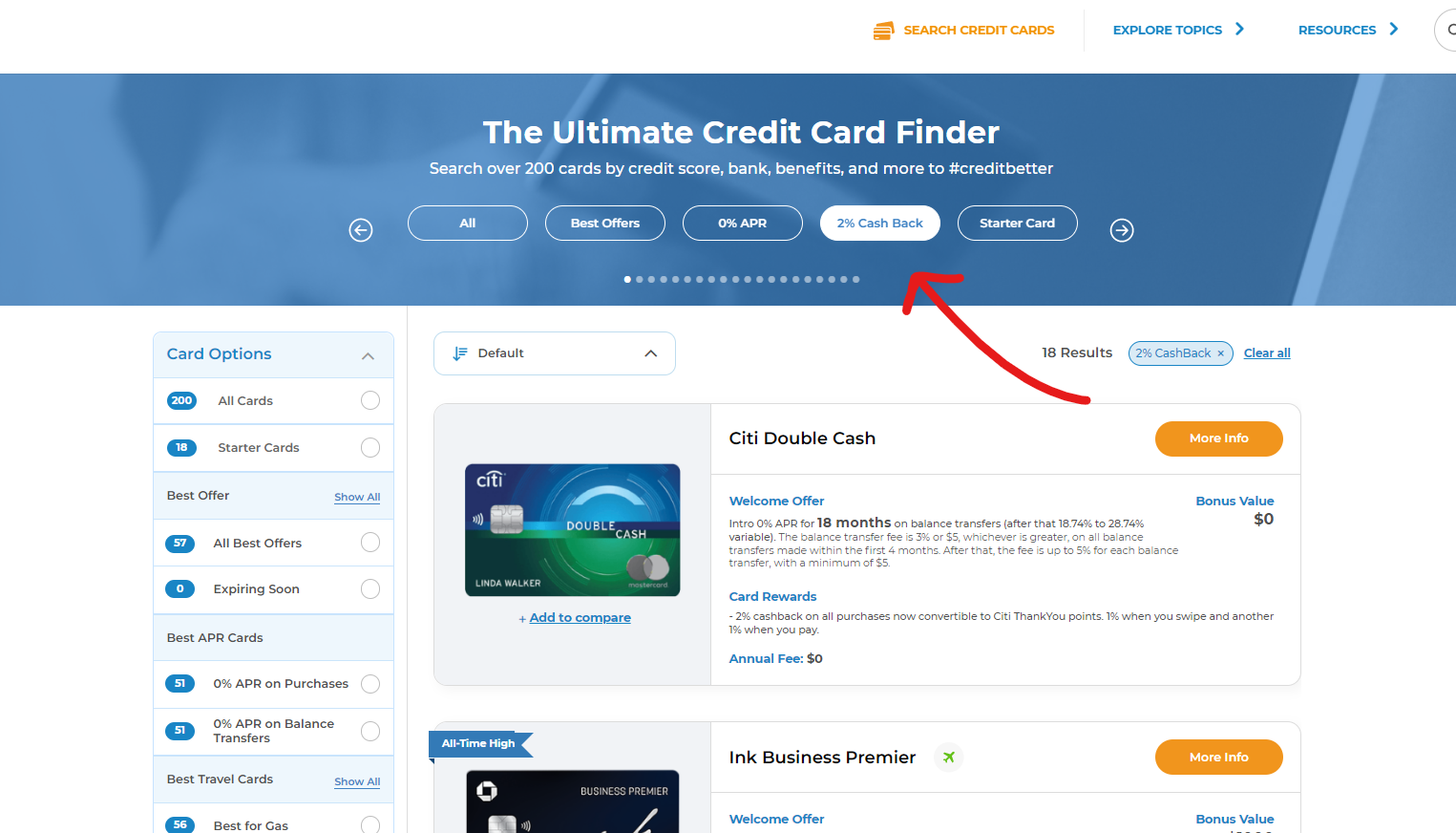

Finding the answer on the ultimate credit card finder

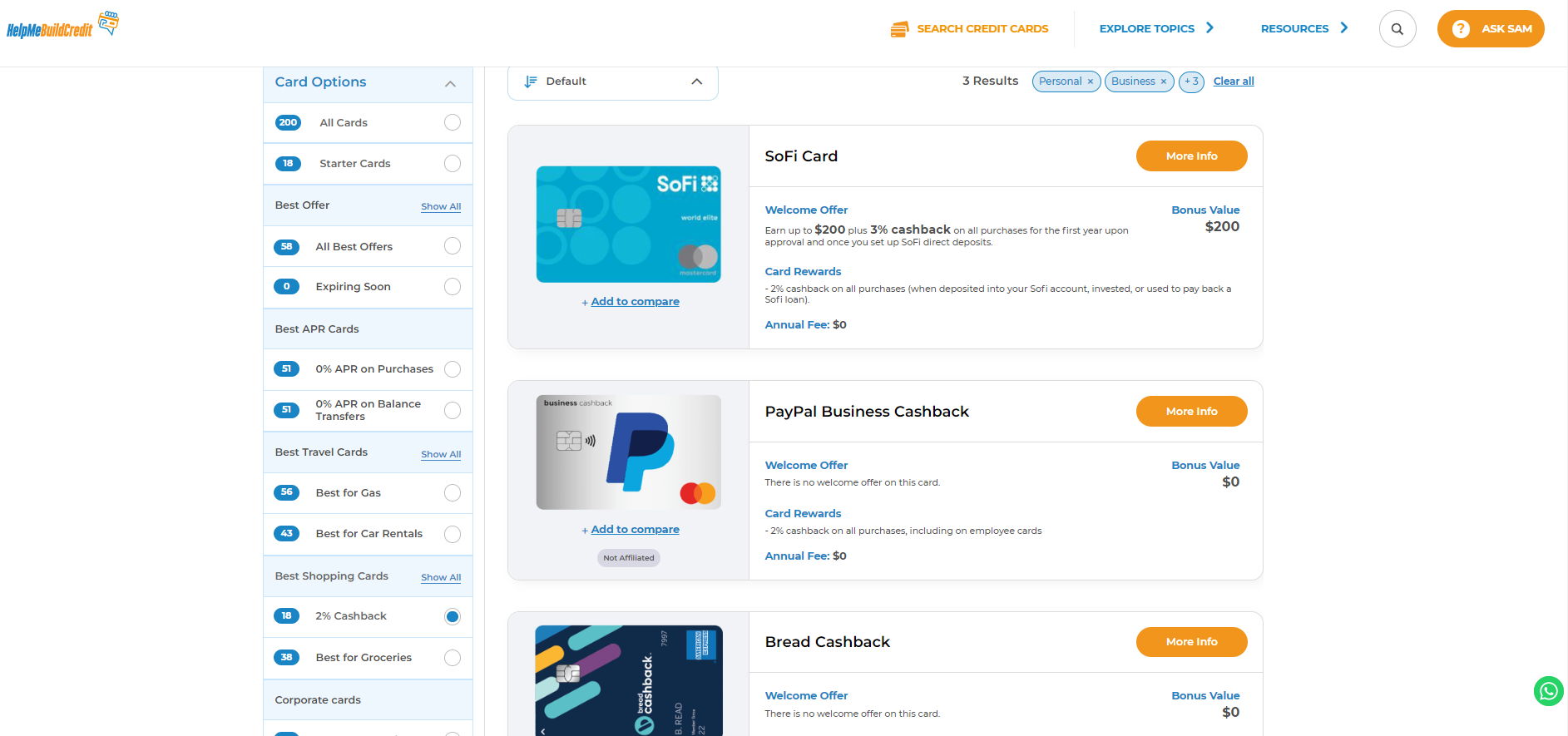

Just click on “2% Cashback”.

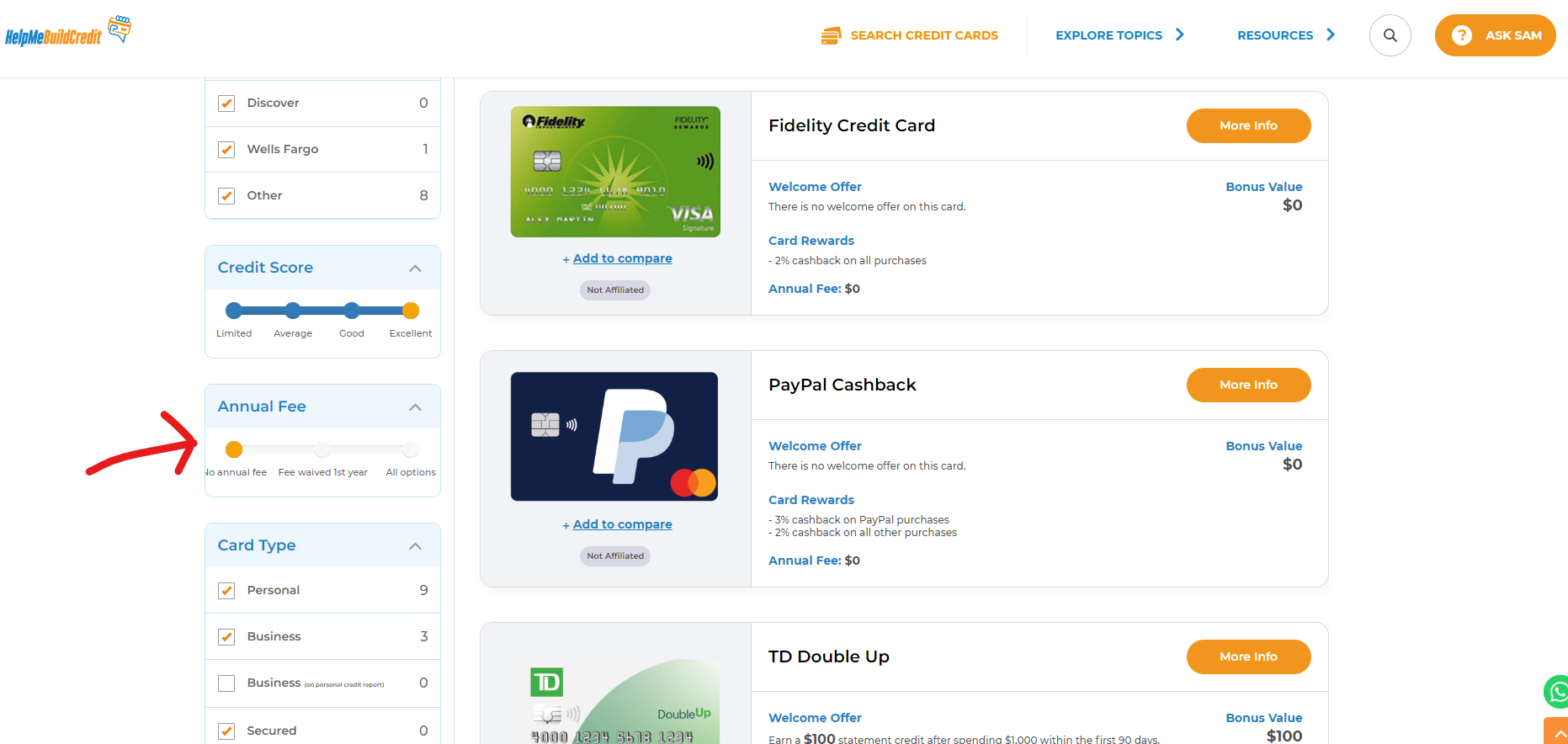

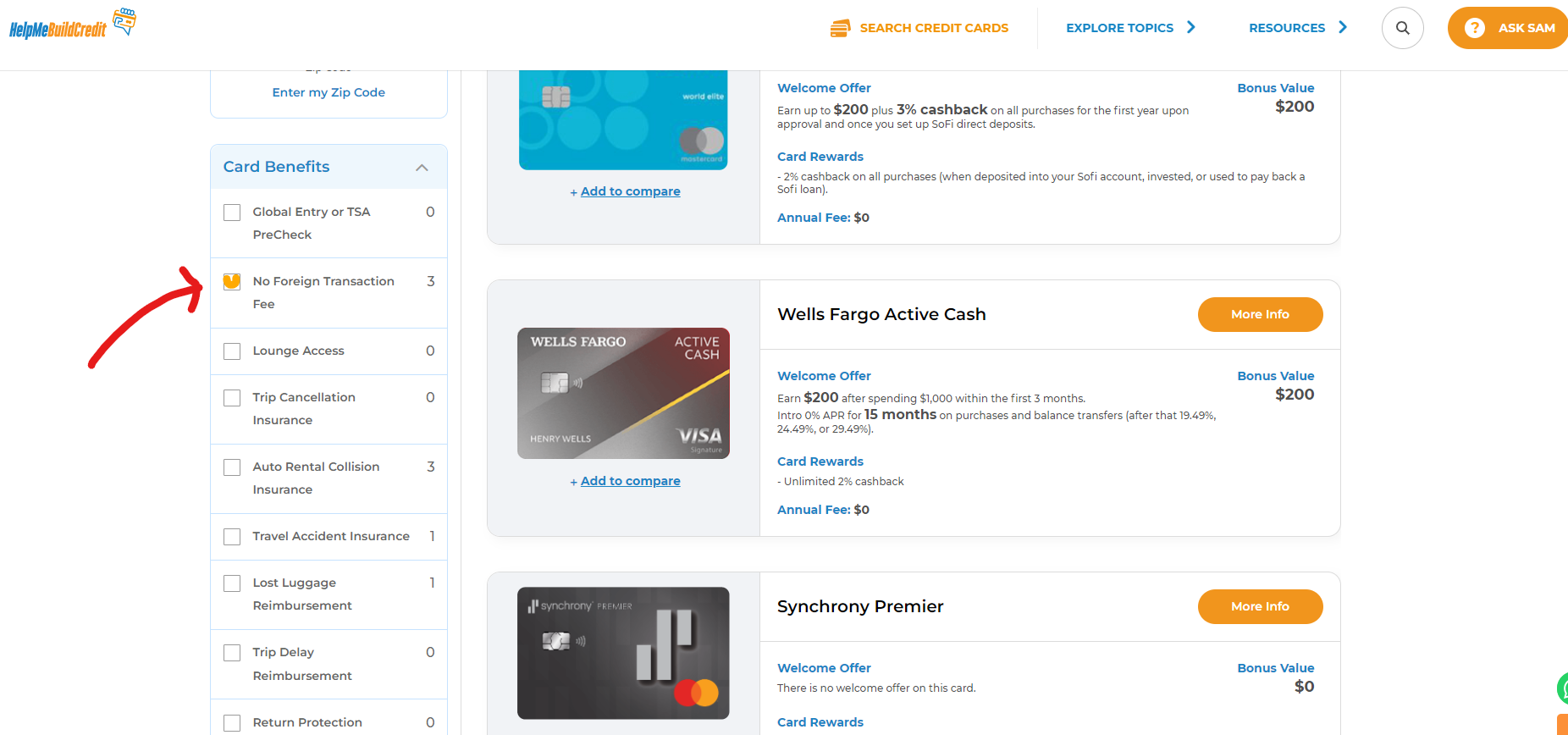

Continue to filter cards to only show “no annual fee cards”

and only cards with “no foreign transaction fees”.

Bingo! It will find three cards that meet these conditions.

Q2 - Which credit cards are approving the highest credit limits?

Bard (my comments are in red): The credit card that is currently approving the highest credit limits is the Chase Sapphire Reserve®. This card offers a starting credit limit of $10,000, but some applicants have been approved for much higher limits. The card also has a number of other benefits, including a $300 annual travel credit, a $100 Global Entry or TSA PreCheck application fee credit, and a Priority Pass Select membership. The annual fee for the card is $550.

Here are some other credit cards that are known for approving high credit limits:

American Express Platinum Card® (doesn’t even have a preset credit limit)

Citi Prestige® Card (Huh? This card is no longer available for new applications for a long time!)

Bank of America® Premium Rewards® Credit Card

Wells Fargo® Platinum Honors® Card (did they just make up the name of a card?)

It is important to note that the credit limit you are approved for will depend on a number of factors, including your credit score, income, and debt-to-income ratio. If you are looking for a high credit limit, it is important to build your credit history and make on-time payments. You can also try applying for a credit card with a higher credit limit.

My take: Not very helpful. Based on my experience and based on results in our Credit Card Database, there are much better cards than the Sapphire Reserve approving for higher limits, such as the Venture X, Ink Premier, and more.

Finding the answer on the Ultimate Credit Card Finder

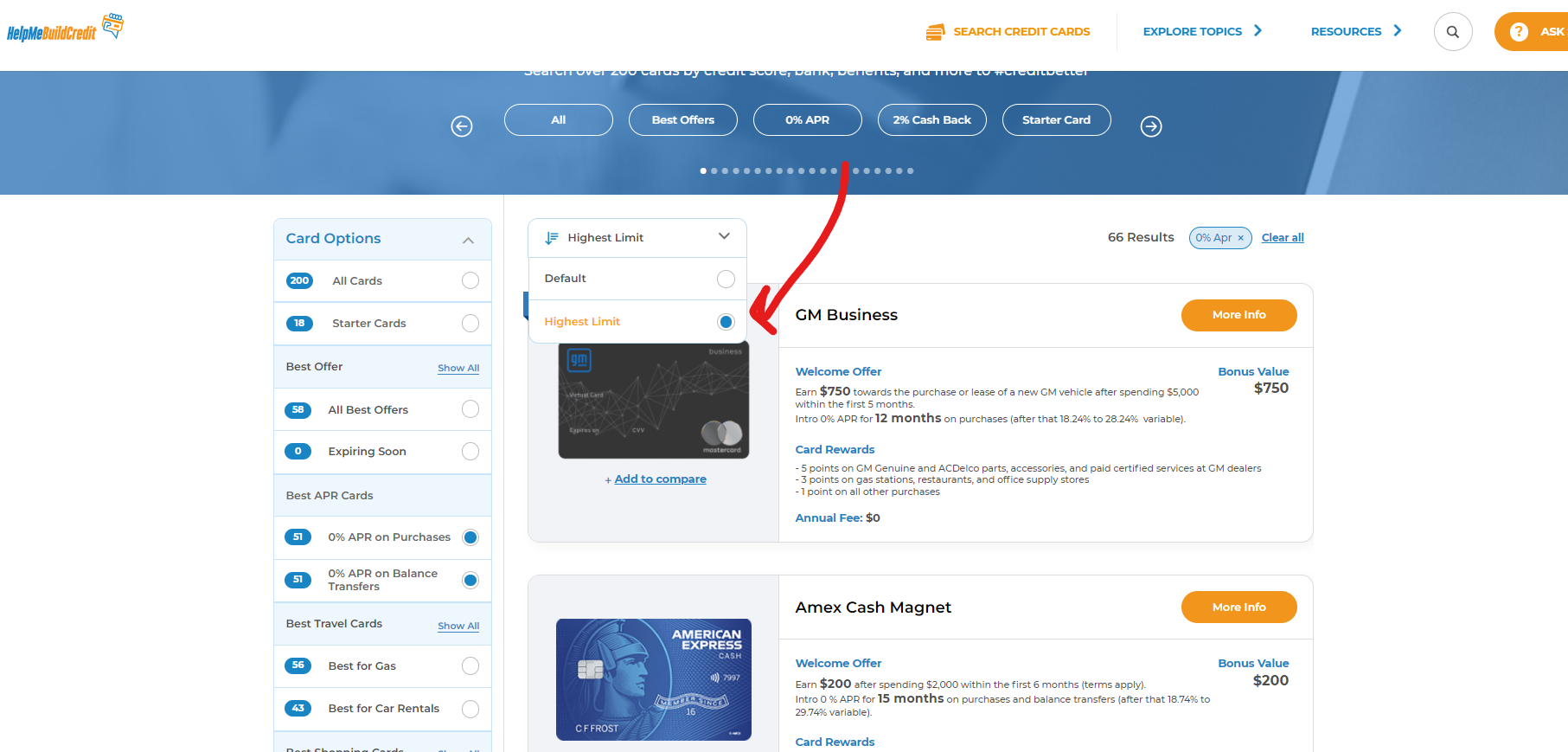

Whenever you search for a credit card with the Ultimate Credit Card Finder you can sort results based on the highest limits.

For example, when searching for 0% APR cards, just hit on sort by “highest limits”. It will show the order of cards based on the average limits approved for other users who reported their results in our Credit Card Database.

Q3 - Does the Chase Sapphire Preferred have lounge access?

Bard: No, the Chase Sapphire Preferred does not have lounge access. Only the Chase Sapphire Reserve offers complimentary access to airport lounges. The Chase Sapphire Preferred does offer a number of other benefits, including a $60,000 sign-up bonus (this was before the 80k offer was live), 2x points on travel and dining, and 1x points on all other purchases.

If you are looking for a credit card with lounge access, the Chase Sapphire Reserve is a good option. However, if you are not interested in lounge access, the Chase Sapphire Preferred may be a better choice.

My take: With this question, I decided to go easy and ask a very basic straightforward question. And finally, here they got it right. So go ahead and take 10 points for this one.

Q4- Which credit cards have price protection?

Bard (my comments are in red): Here are some of the credit cards that still have price protection:

Capital One SavorOne Cash Rewards Credit Card

Capital One Quicksilver Cash Rewards Credit Card (false)

Capital One Walmart Rewards Mastercard

Navy Federal More Rewards American Express® Credit Card (not familiar with this card but I don’t see it as a benefit listed on card)

Rakuten Cash Back Visa® Credit Card (not familiar with this card but I don’t see it as a benefit listed on card)

REI Co-op® Mastercard®

UBS Visa Infinite Credit Card

Wells Fargo Visa Signature® card

HSBC Premier World Elite Mastercard® credit card (false)

Discover it® Cash Back (false)

It’s important to note that these are just a few of the many credit cards that offer price protection. Be sure to compare your options carefully to find the best card for your needs.

It’s also important to read the fine print of your credit card’s price protection policy to understand what is and isn’t covered. For example, some policies may have exclusions for certain types of items, such as electronics or gift cards. (I cut off the rest of the response)

My take: Too much false info. Not a very reliable answer.

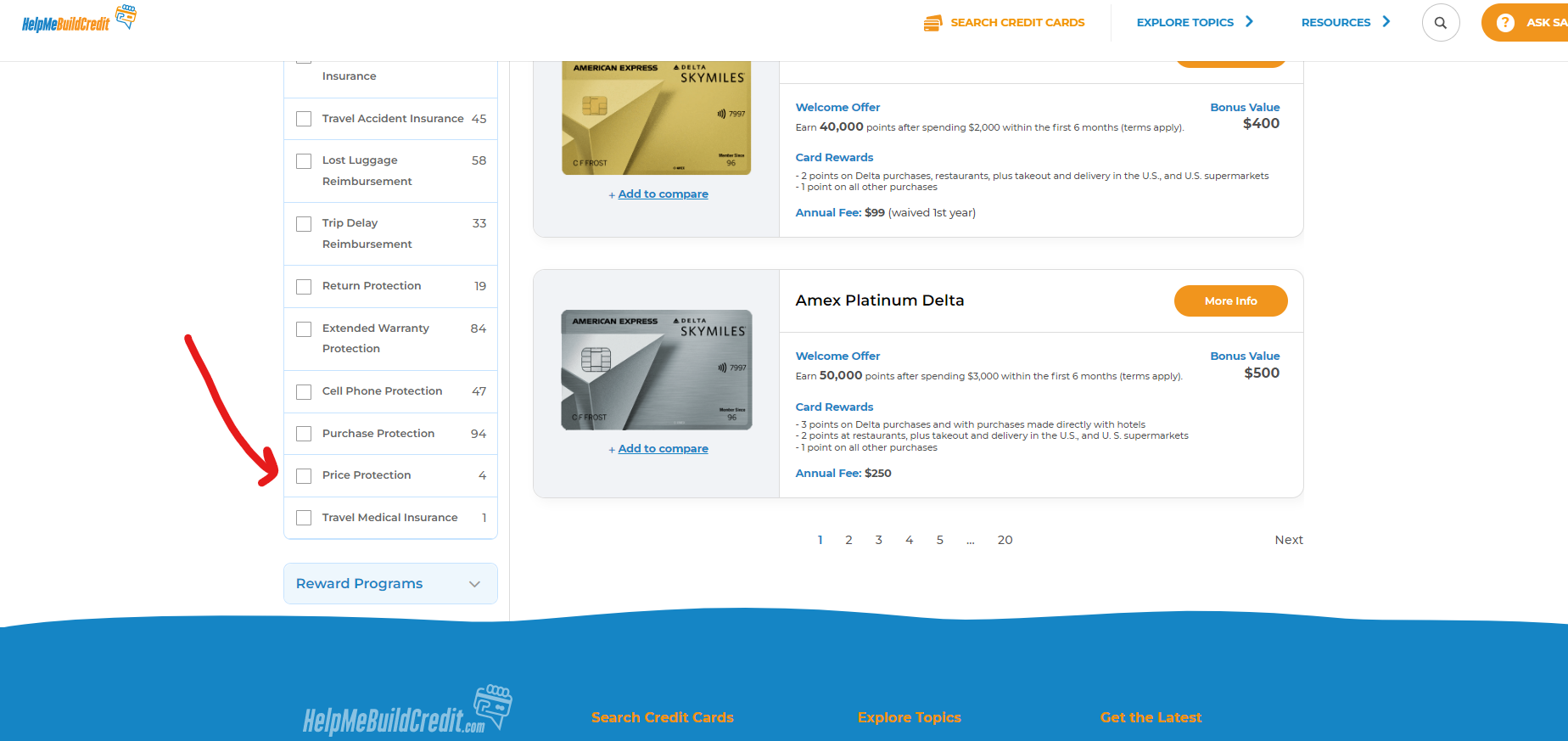

Finding the answer on the Ultimate Credit Card Finder

Just hit on the “price protection” filter setting and bingo!, you will have the list of cards that offer price protection, sorted out from over 200 cards.

Q5 - Which good welcome bonuses are available now if I can only spend max $4,000 in three months?

Bard (my comments are in red): Here are some of the best welcome bonuses available now if you can only spend a maximum of $4,000 in three months:

Chase Sapphire Preferred®: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

American Express Gold Card: Earn 60,000 Membership Rewards® points after you spend $4,000 on purchases in the first 6 months of card membership.

Citi Premier® Card: Earn 60,000 bonus ThankYou® Points after you spend $4,000 on purchases in the first 3 months from account opening (There is a 75k offer available now – so it doesn’t give you the best offer available).

Chase Freedom Unlimited®: Earn $200 Bonus after you spend $500 on purchases in your first 3 months from account opening (not such a great offer).

Capital One SavorOne Cash Rewards Credit Card: Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening (not such a great offer).

My take: On our website we have many more better offers listed even with an only $4k budget.

Capital One Venture – Earn 75,000 points after spending $4,000 within the first 3 months.

Citi Premier – Earn 75,000 points after spending $4,000 within the first 3 months.

Citi AAdvantage Platinum – Earn 75,000 points after spending $3,500 within the first 3 months.

Alaska Airlines -Earn 70,000 miles and Alaska’s famous companion fare after spending $3,000 within the first 90 days,

Plus, it failed to show the better offer on the Citi Premier Card.

Finding the answer on the Ultimate Credit Card Finder

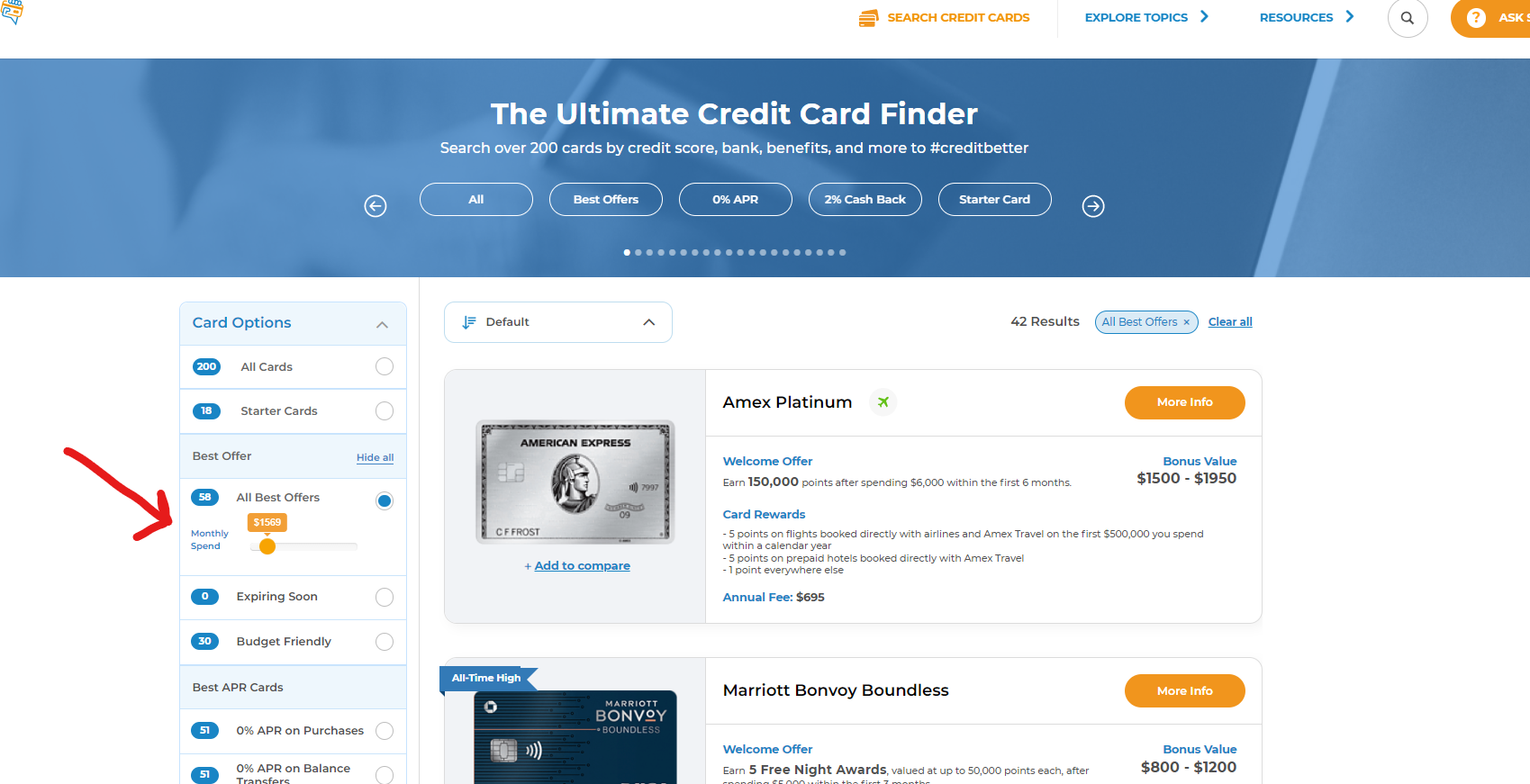

On our website you can search the best welcome bonuses based on your budget. You can set it to show you offers with only $1500 needed in spend per month etc.

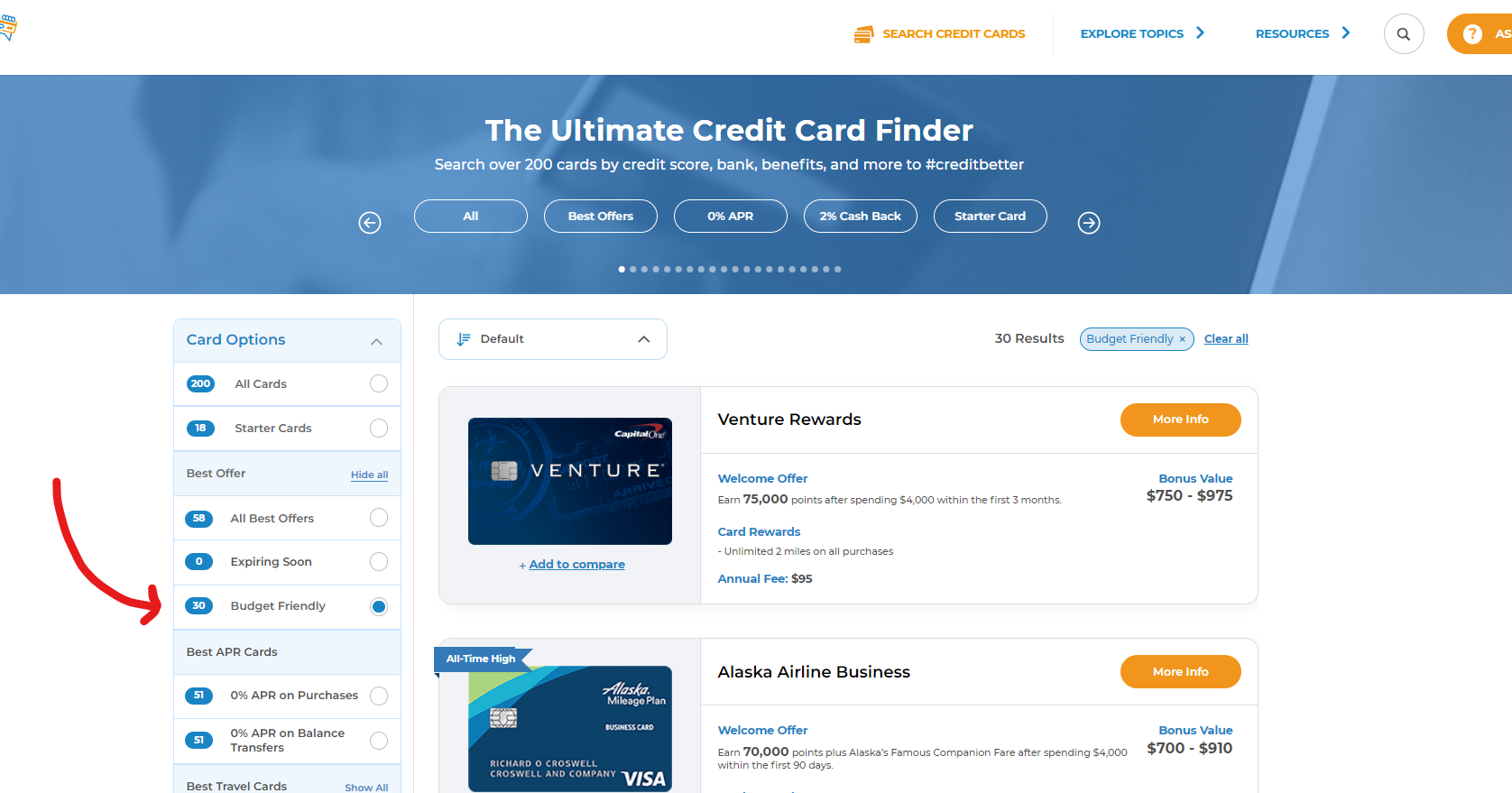

Alternatively you can choose to filter based on “budget friendly offers”. In such a case, it will only show you results with less than $5k spend needed.

Q6 - Tell me everything you know about Helpmebuildcredit.com

Bard (my comments are in red): Help Me Build Credit is a website that provides information and resources on how to build credit. The website was founded in 2017 by Chaim Geller, who wanted to create a resource that would help people learn how to build their credit in a safe and affordable way.

The website offers a variety of resources, including:

Blog posts that provide tips on how to improve your credit score

A credit card comparison tool that helps you find the best credit card for your needs

A credit monitoring service that keeps track of your credit score and report (false 🙂 )

Help Me Build Credit is a free resource, and all of the information on the website is provided by credit experts. If you’re looking for ways to improve your credit score, Help Me Build Credit is a great place to start.

Here are some of the pros and cons of using Help Me Build Credit:

Pros:

- The website offers a variety of resources, including blog posts, and credit card comparison tools.

- The website is free to use.

- The information on the website is provided by credit experts.

Cons:

- The website is not affiliated with any specific credit card issuer, so you may not be able to find the best possible offer (Just the opposite. Because we post all links, not only affiliated links, we always make sure to have the best offer listed).

- The website does not offer any personal advice or recommendations (False. Any user can reach out to us for personal advice and guidance via the Ask Sam helpdesk or Whatsapp).

Overall, Help Me Build Credit is a great resource for people who are looking for information on how to build credit. However, it is important to remember that the website is not affiliated with any specific credit card issuer, so you may not be able to find the best possible offer. If you are looking for personal advice or recommendations, you should consult with a financial advisor.

Here are some additional details about Help Me Build Credit:

The website is based in Brooklyn, New York.

The website has been featured in a variety of publications, including The New York Times, Forbes, and USA Today (I’m not aware of this;) ).

The website has a team of credit experts who provide the information on the website.

The website is updated regularly with new information and resources.

If you are looking for information on how to build credit, Help Me Build Credit is a great place to start. The website offers a variety of resources that can help you improve your credit score.

My take: Finally, we got some sound advice from Bard.

Conclusion

I think AI has a lot of potential. Our team of developers are working on a few AI solutions for our website which we hope to introduce to you shortly. But in the meantime, a tool like Bard (based on my test) can be great to get some quick, basic answers about your credit cards, but for anything deeper, it’s not very reliable.

In the meantime, I am happy to offer you a great and advanced website that I’m proud to call the “best place to find a credit card quickly and easily!”

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments