Amex released that they are adding cell phone protection as a new benefit to their luxury credit cards, as of April 1st 2021.

Being that cell phones are in high use, AND very likely the most expensive possession a typical person carries around nowadays, cell protection is a much-needed benefit.

What Cell Phone Protection Will Cover

So bravo to Amex.

Smartly, Amex now decided to jump onto the bandwagon and do what other banks have done, banks such as Citi, Chase, and Wells Fargo, and implement cell phone protection as a benefit on some of their cards (see a full list of eligible cards here).

Think of your child and how easily he can grab your phone and accidentally, or purposefully :), smash the screen.

Luckily, a cracked screen is included in the coverage of cell phone protection, under the category of cosmetic damage.

Cell phone protection will also cover stolen or damaged phones. So when your phone slips out of your pocket as you step out of your car, and splashes into a fresh rainwater puddle, you can be protected with cell phone protection.

The cell phone protection will cover for a maximum of $800 per claim and up to two claims over 12 months. There is a $50 deductible per claim you file.

How To Activate Coverage?

To activate converge you need to pay your monthly “Eligible Cellular Wireless Telephone bill” with your “Eligible Card Account”. That means the credit card with cell phone protection must be used to pay your monthly bills for the cell phone you need protection on. The previous month’s bill must have already been charged on the Eligible Account.

You do NOT need to purchase the phone with your eligible credit card in order to activate coverage.

“Cell phone protection” is not the same thing as “purchase protection”. The difference between the two is that purchase protection covers the purchase up to 90 days after the purchase is made, while cell phone protection protects your phone for its lifetime (as long as the monthly phone bill is paid with the eligible card.

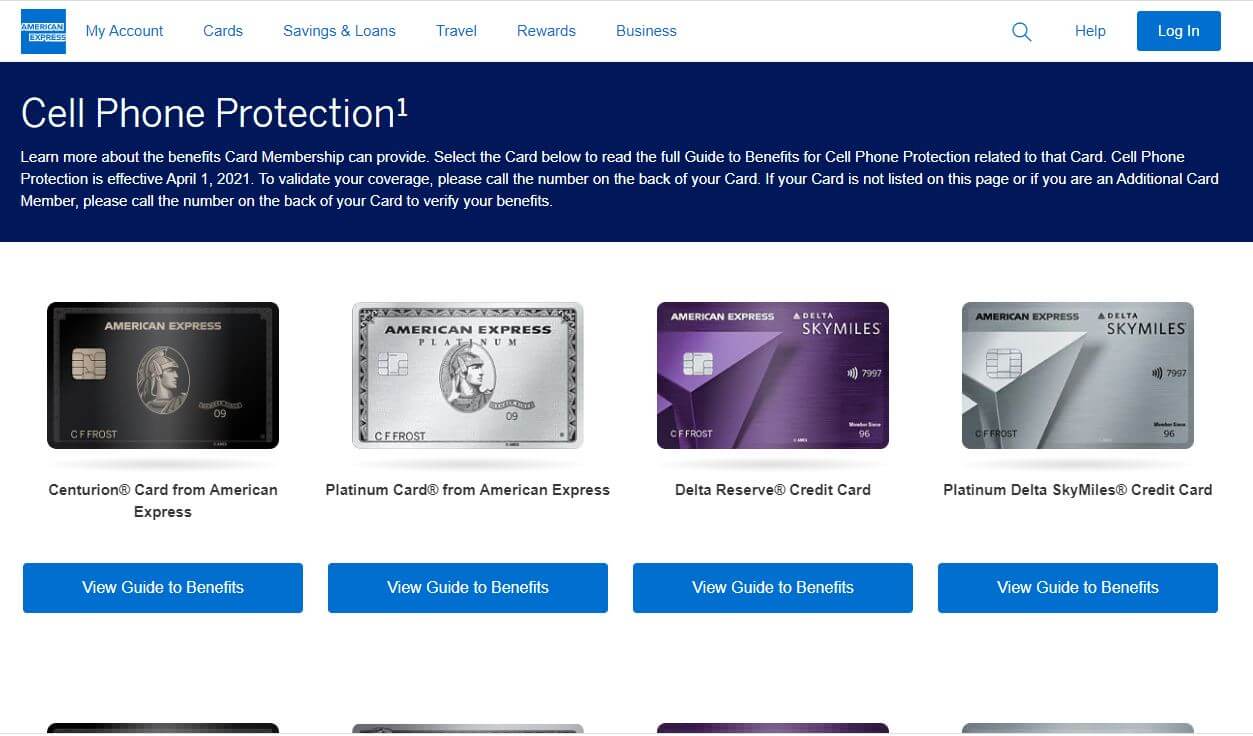

What Cards Will Have Cell Phone Protection

Starting, April 1st, 2021, Cell phone protection will be added to the following cards.

Amex Centurion Card

Business Centurion Card

Delta SkyMiles Platinum Business Card

Delta SkyMiles Reserve Business Card

The Platinum Card® Exclusively for Charles Schwab

The Platinum Card® Exclusively for Morgan Stanley

The Goldman Sachs Platinum Card

The Centurion® Card Exclusively for Goldman Sachs

![Best Credit Cards With Airport Lounge Access [2024]](https://helpmebuildcredit.com/wp-content/uploads/2022/06/post-on-cards-with-airport-lounges.png)

![The 10 Best 0% APR Credit Cards For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2023/07/Post-on-best-0-apr-cards3-1080x675.png)

![The 10 Best Credit Card Offers For April [2024]](https://helpmebuildcredit.com/wp-content/uploads/2024/03/post-on-best-offers-april-2024.png)

0 Comments