Your #1 source for all things credit

Find your way through the credit maze with helpful advice, grab-worthy offers, and industry insights all in one place.

- Read tried & tested tips for building your credit

- Explore 1000s of industry-proven, expert-backed credit topics

- Search and compare all the latest credit card offers – ranked by the benefits you’re looking for

Find the best cards for you

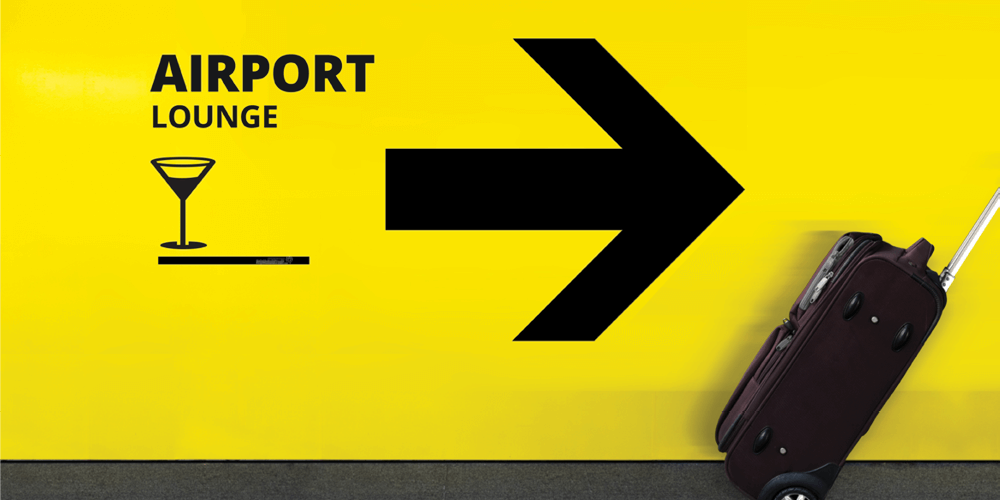

Best Credit Cards With Airport Lounge Access [2024]

by Sam | April 18, 2024 | Credit Card Info, Travel | 0 Comments

Combining Same Day Credit Inquiries: Who Does and Who Does Not?

by Sam | April 16, 2024 | Credit Card Info | 4 Comments

How To Check Your Credit Card Application Status By Phone or Online

by Sam | April 14, 2024 | Credit Card Info | 8 Comments

The 10 Best 0% APR Credit Cards For April [2024]

by Sam | April 11, 2024 | Credit Card Info, Credit Card Offers | 0 Comments

Will It Start Costing You More To Swipe On A Premium Card?

by Sam | April 9, 2024 | Credit Card Info | 0 Comments

My Prediction About The 3% Robinhood Card. Is It Just A Marketing Stunt?

by Sam | April 7, 2024 | Credit Card Info | 0 Comments

The 10 Best Credit Card Offers For April [2024]

by Sam | April 4, 2024 | Credit Card Info, Credit Card Offers | 1 Comment

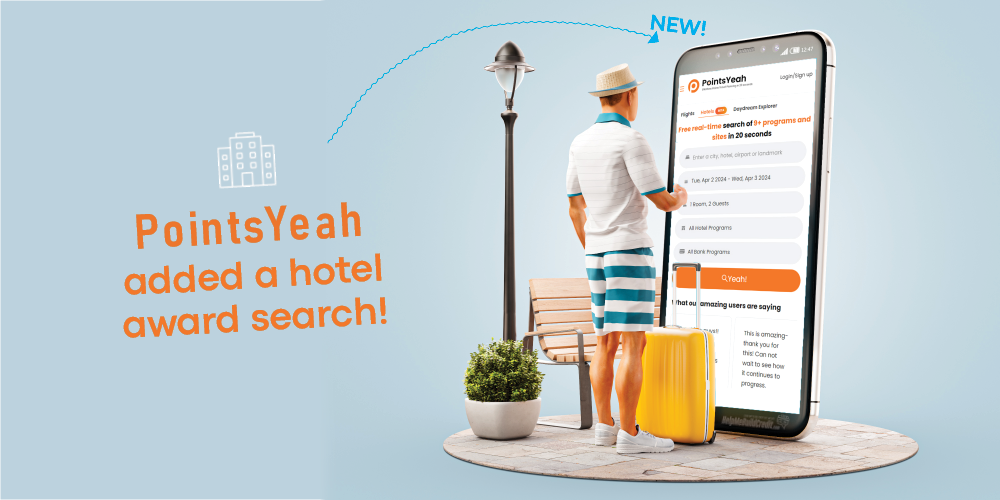

PointsYeah Added A Hotel Award Search

Only 2 Days Left! United Business 100k Offer

by Sam | April 1, 2024 | Credit Card Info, Credit Card Offers | 0 Comments

The Best Websites To Monitor Your Credit Report For Free

by Sam | March 31, 2024 | Identity Theft | 4 Comments

How To Build Credit History Properly Once And For All

by Sam | March 5, 2024 | Building Credit, credit | 0 Comments

6 Ways To Get Approved For Your First Credit Card And Start Building Credit

by Sam | February 27, 2024 | Building Credit, credit, First Credit Card | 14 Comments

Do Utility Or Phone Bills Help Build Credit?

by Sam | February 4, 2024 | Building Credit, credit | 0 Comments

How Long Does It Take To Build Credit?

by Sam | November 7, 2023 | Building Credit, credit | 0 Comments

How To Make Sure Our Emails Don’t Get Lost In The Promotional Tab

by Sam | March 26, 2024 | About The Blog | 0 Comments

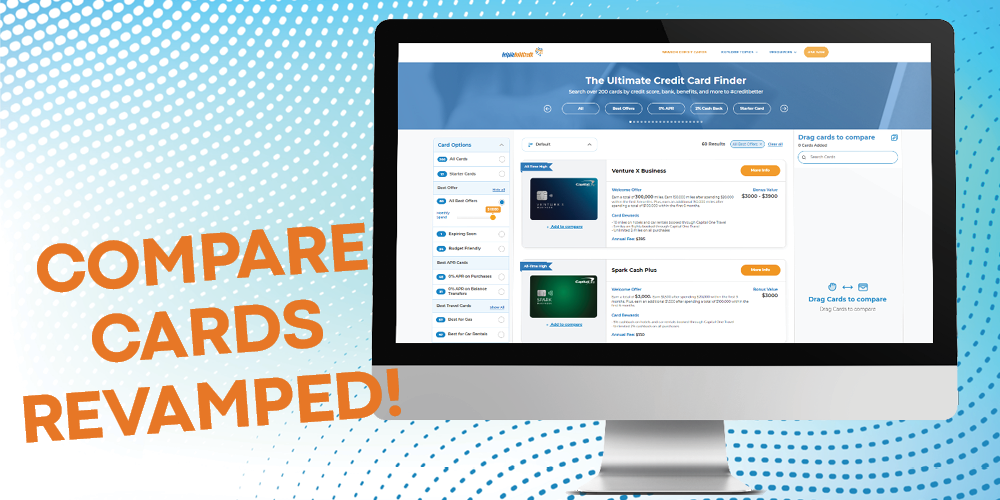

The Compare Cards Section Has Been Revamped!

by Sam | February 18, 2024 | About The Blog, Credit Card Info | 0 Comments

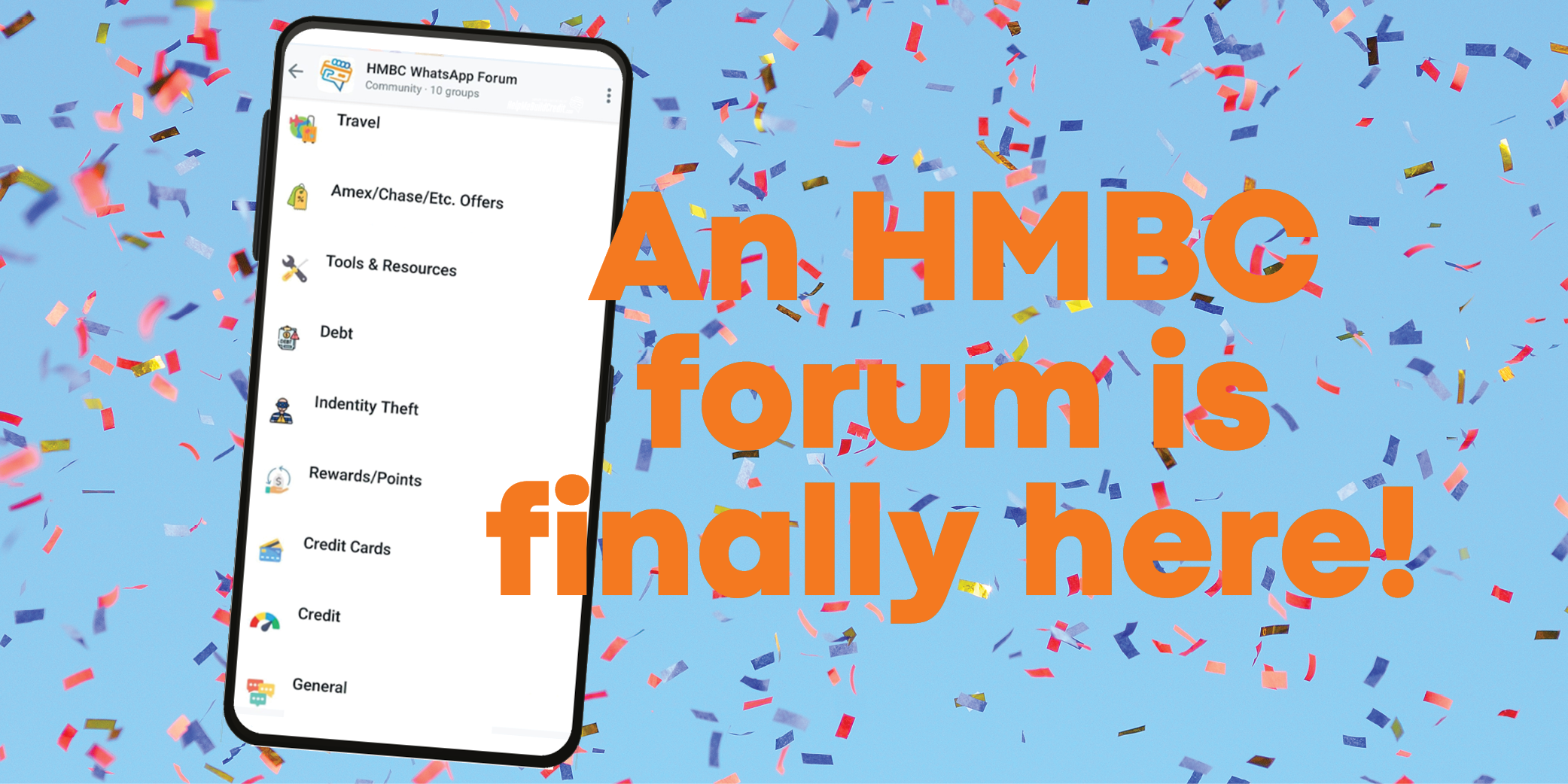

The HMBC WhatsApp Forum Is Finally Live!

by Sam | January 23, 2024 | About The Blog | 0 Comments

My 2023 Predictions (Wishes) – Some Of Them Right:) And Some Of Them Wrong:(

by Sam | December 31, 2023 | About The Blog | 0 Comments